Starlink: Elon Musk, Jeff Bezos and the race for the Internet from space

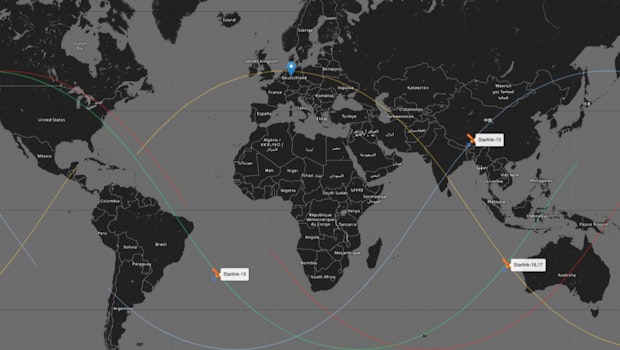

Jeff Bezos is working on the project “Kuiper”, Elon Musk on “Starlink”. This race is less about the most advanced technology – it is about the lowest costs. (Graphic: with dpa)

Given that more than 900 of Elon Musk’s Starlink satellites orbit the earth at an altitude of 550 kilometers, it is not that easy to discover them. The chances are best over Berlin in the morning if you look to the southeast just before sunrise. But Berlin is a bright city. There is a video from Tübingen in which Starlink satellites can be seen shooting across the sky at around 27,000 kilometers per hour, in the so-called pearl necklace formation: In a row, one behind the other, like stars flying polonaise across the night sky.

Elon Musk gives the rhythm of the satellite dance. His share of around 20 percent in the electric car manufacturer Tesla makes him the richest person in the world (as of January 2021). He is the founder of SpaceX, the only private company that flies NASA astronauts to the International Space Station (ISS). With Hyperloop – an air cushion train in a tube – Musk wants to detach rail traffic from the rails. And with Neuralink he tries to establish a direct connection between the computer and the brain.

But Musk’s real lifelong dream is even bigger – or at least further away: Musk wants to build the first colony on Mars. What he needs for this: money. The kind of money none of his projects has made so far. Tesla may have posted positive annual results for the first time last year – $ 721 million in profit – but Musk needs a company with billions in profits to fund his vision. His network of 11,943 Starlink satellites is said to throw these billions off. In the long term, their number is expected to grow to 42,000. The idea behind it: Large areas of the world are not or poorly connected to the Internet; Musk wants to provide these rooms with satellite internet. Laying fiber optics and copper cables is often only worthwhile in places where people live close together. Away from the metropolitan areas, for example on the sea, in Siberia or North Idaho, according to Musk’s vision, people, companies, aircraft and ships should use a satellite dish to send their data to the next satellite. This sends it by laser beam via a chain of other satellites to a ground station.

In itself, satellite internet is nothing new, but so far it is so expensive, weak and complicated that it has no chance of becoming a mass application. Since the 1990s, projects such as Iridium, Teledesic, Leosat and Globalstar have failed because of this. But Musk is Musk. And what are his chances? “Do you want me to be the first person to say Musk is going to fail?” Asks Chris Quilty, founder of space analyst Quilty Analytics, laughing back on the phone.

1 of 6

The new space race of the tech bosses

Whether Musk’s plan works will also depend on whether he has his lead can hold at an altitude of 550 kilometers. The company Oneweb – with the participation of the British government – launched satellites into space with a Russian Soyuz rocket in December 2019. 19 satellites out of a planned 48,000. The EU is also researching a satellite mega-constellation in a first study – for around 7.3 billion dollars. Three projects from China want to launch several hundred satellites into space. But with Amazon’s Jeff Bezos, the competition is more personal. Since he and Musk met for dinner in 2004, they’ve been teasing each other’s space programs in interviews and on Twitter. At times, SpaceX is said to have even had an email filter for the term Blue Origin, the name of Bezos’ space company. Now Bezos is also building a swarm of internet satellites called Kuiper.

Musk is currently part of the company Oneweb, Bezos and the rest by a beta version: A “Better Than Nothing” package has already been sent to some customers in North America for a purchase price of $ 499 plus a monthly service fee of $ 99. Beta testers like the programmer Brett Batie report on their experiences on Youtube: Starlink is delivered as a pizza-sized, white satellite dish with a WLAN router. Outside Batie’s door in northern Idaho, it takes the Starlink dish 15 minutes to align to a satellite orbit. Batie’s first speed test shows: With a download of 50 megabits and an upload of twelve megabits per second, it is roughly twice as fast with Starlink in North Idaho as an average broadband connection in Germany of 24.6 megabits per second. According to an entry in the commercial register, there is already a Starlink Germany GmbH in Frankfurt am Main. However, it is still unclear when the service will actually be launched in Germany. But Deutsche Telekom has already expressed interest: “For me, this is a technology to be taken very seriously,” said Deutsche Telekom boss Timotheus Höttges at a recent conference.

SpaceX’s Starlink has begun public beta testing ~

– $ 499 upfront for satellite dish and router

– $ 99 / month for subscription service

– 50 to 150 mbps download speeds

– designated app (currently on all store) pic. twitter.com/gJ2vYAfdrU— Space Updates (@ Updates4Space) October 31, 2020

Starlink is supposed to be the cash cow that brings Musk to Mars.

Musk’s advantage in the new race to satellite Internet is that he is leading the rocket launch industry with SpaceX. In November, one of its rockets flew NASA astronauts in a Crew Dragon capsule called Resilience to the International Space Station. The capsule is now docked there. The reusable engines flew back to earth – without a pilot – and landed on a floating landing station in the Atlantic. David Limp, the head of the Kuiper project at Amazon, could use a rocket launch company like this. At a space conference in December 2020 he said: “If you know someone out there who has a rocket – give us a call!”

More than 50 years after the moon landing in 1969, a new space race has broken out between the two richest men in the world. The so-called Big Four of satellite communication – Intelsat, Eutelsat, SES and Iridium – have been shooting satellites into space since the mid-1960s; but so far they have mostly put geostationary satellites into orbit. These are large satellites with the highest possible data throughput, which then send television broadcasts, for example, from a geostationary orbit – around 36,000 kilometers above the earth. Geo-satellites rotate with the earth and can stand statically over a certain point, like a telephone pole 36,000 kilometers high. As a result, they only cover a certain region of the world – and are the reason why people can screw their satellite dishes onto their roof with a fixed orientation.

Paradigm shift: New Space

Between the geo-satellites of the Big Four and the swarms of satellites from SpaceX, there has been a paradigm shift called New Space: since the space race of the 1960s -Years, space travel mainly revolved around the budgets, constructions and missions of the state space agencies Nasa, Esa or Roskosmos. With the end of the Cold War and the fading of the space euphoria of the space age, this model of state-financed space travel lost its innovative strength. In the early 2000s, young billionaires like Bezos and Musk began shaking up the space industry with the money and methods of Silicon Valley, creating space companies like Blue Origin and SpaceX. Space has been privatized. And while NASA’s recent space missions cost $ 775 million, Musks SpaceX is now offering flights for $ 62 million.

If Musk fails, it is because of the cost

Since the paradigm shift, the industry is now looking primarily at two factors: mass and cost. “The space industry is already worth $ 400 billion and will grow to $ 1 trillion in the next ten years,” estimates analyst Chris Quilty. “Satellite communication is currently a 22 billion-a-year industry,” he explains in a telephone conversation. “Only then do earth observation, optical images, radar satellites, spy satellites come.” The rocket launch industry, led by Musk, sees Quilty as a catalyst of the industry.

Trefis technology and financial analysts estimate that SpaceX is up to date could generate $ 1.2 billion in revenue with 15 rocket launches a year. With Starlink, according to the analysts, Musk could turn over ten billion US dollars a year as early as 2025. Morgan Stanley’s bankers believe that satellite internet will become a so-called “winner takes most” market – that is, that there is only room in the sky for one major provider. Starlink, according to an October 2020 analysis by the bank, could have around 364 million customers in 2040 and earn $ 21 a month with each customer – a total of over $ 7 billion a month. Starlink is said to be the cash cow that brings Musk to Mars. The contract for the current Starlink beta version shows how closely Musk’s projects are linked to one another: Users must already sign there that Mars is a free planet.

The Starlink satellite dish is easy to assemble and aligns itself to the nearest orbit. The radiation to the respective satellites is controlled electrically. (Screenshot: Brett Batie)

In the medium term, the new space race is less about technical feasibility – the beta version has already shown that Starlink works. It’s about cutting costs. Antennas and satellite dishes for the fixed, geostationary satellites only need to be aligned once. They’re made of metal and can be made for $ 50. Starlink satellite dishes roughly align themselves – and then have to track dozens of satellites at once. This only works via electronically directed radiation. Quilty estimates that an antenna with an electronically controlled beam costs between $ 1,500 and $ 2,000. Elon Musk sells them to beta testers for only a third of the price. “For a while, you will lose money with every single customer,” Quilty estimates. “But you could have said the same thing about Tesla or Amazon.”

For Quilty, Starlink is caught in a development dilemma: “The key to reducing electronics costs is high volumes. But in order to sell high volumes, it has to be cheap. ”Meanwhile, Jeff Bezos Elon Musk is also hot on the heels of the customer terminals: In December, Amazon’s Kuiper project presented its own satellite dish that is only 30 centimeters in diameter – and through a new construction should be particularly cheap in production.

The Silicon Valley – Corporations could expand their global lead with their own global Internet.

How big the cake actually is, from the Musk, Bezos and the wanting to take a piece off other projects is still uncertain. “Traditional is a last resort technique, ”Quilty says. The big question is whether Musk will remain a specialty supplier or whether it will be able to turn Starlink’s Internet into a mass product. “You could say this is crazy – satellites for DSL and cellular communications, but in some cases multinational corporations, for example, want their entire global office in one network,” he explains. “By the way, this is also our thesis, why Amazon also got on board.”

Many of the big tech companies are trying to offer their services from the air with their own internet. But it’s tricky: Facebook is still working with Airbus on internet-radiating drones at an altitude of 20 kilometers; Google had to crush its internet hot air balloon called Project Loon again because of the high costs.

Starlink announced in October 2020 that it would work with the Microsoft Azure Cloud. Using a service called Azure Orbital, users should then be able to access the Azure cloud directly via Starlink or its competitor SES. Microsoft also wants to build mobile data centers the size of a container for Azure Orbital. Some of them, according to Microsoft, are already used militarily.

The Silicon Valley Corporations could expand their global lead with their own global internet: What would it mean for Tesla if the cars had their own, independent internet connection, no matter where they are? Amazon already controls large parts of the retail sector. Large parts of the Internet run on Amazon’s AWS servers – and so do 80 percent of German DAX companies. What would it mean if Amazon also offered its customers their own internet connection for this purpose? The billion-dollar companies from Silicon Valley could then create completely their own living environments: Buy a new Amazon Fire tablet for the children with Amazon’s Echo in Amazon’s Internet on Amazon.com. In such a market, competitors without their own rocket division could pack up – or offer their services via Amazon Web Services.

In space, data should be sent by laser : From satellite to satellite – and then back to earth. (Image: Mynaric)

Does it ultimately depend on laser technology from Germany?

By radio, from satellite to ground station, Starlink will not be able to handle the data volume of millions of users. SpaceX and Amazon are not only concerned with the Internet for users like Brett Batie in Idaho, but also with industrial customers. But Musk already has a solution: space lasers. In Germany there are two companies that are among the best in the world in this type of laser communication: Tesat from Backnang near Stuttgart and Mynaric from near Munich.

The Tesat lasers are already being used for communication by the two Earth observation satellites Sentinel-6. “The forest fires in Brazil could be seen very well with the Sentinel satellites – and thanks to the lasers, such images can be evaluated in the EU eleven minutes after they were taken,” explains Gerd Kochem from the German Aerospace Center. “It is clear that laser communication works,” he says. Megaconstellations with thousands of satellites are of course a different yardstick. But there, too, the “crux of the matter is whether the planned systems are commercially viable,” he emphasizes.

The new Internet architecture is intended to “complement, not replace” the old structure with fiber optics, copper cables and transmitter masts, explains Sven Meyer-Brunswick in a zoom call. He is the head of operations at Mynaric. Its zoom background is a drone with glowing red laser beams. “It doesn’t make sense to lay fiber optics in the last corners of the foothills of the Alps,” he says. “Milk cans are better connected to satellites.” The following applies: the more densely clustered, the more fiber optics and 5G antennas; the further away from cities, the more satellite.

A laser module from the Munich company Mynaric. (Photo: Mynaric)

“It’s about leveraging economic potential, that’s why SpaceX and Amazon are there,” Meyer-Brunswick is convinced. “Even in turbines, terabytes of data accumulate in flight, which are only read out on the ground.” If you were to read out this data in the air, he estimates, you could prepare for repairs and maintenance before landing.

Also for them Classic high finance should be of interest to Starlink: In 2015, fiber optic cable provider Hibernia Networks was worth around 300 million dollars to lay the fastest fiber optic cable between the USA and UK – Hibernia is only 17 milliseconds faster than other fiber optic connections between the continents. According to calculations by Real Engineering, Starlink could be another 22 milliseconds faster than Hibernia, and thus also offer a premium connection for millisecond traders in New York and London.

At the moment, Mynarics lasers cannot keep up with the data volumes of fiber optic cables: They transmit just ten gigabits per second. “That would still be too little for an Internet backbone. But in principle we use the same technology as fiber optic cables – for more speed we only have to adapt the transmission technology, not research it again, ”says Meyer-Brunswick. His boss, Mynaric CEO Bulent Altan, worked for Elon Musk’s SpaceX for ten years. “The New Space is not about space, but about business cases here on the floor,” says Meyer-Brunswick.

This may you are also interested

The post Starlink: Elon Musk, Jeff Bezos and the race for the Internet from space appeared first on World Weekly News.