Players and online forumers have done amazing chaos on Wall Street

A huge dust turmoil in financial circles that the average price of shares of an American console game store on the brink of closure due to the coronavirus epidemic soared to gigantic heights in a few weeks at unprecedented speeds

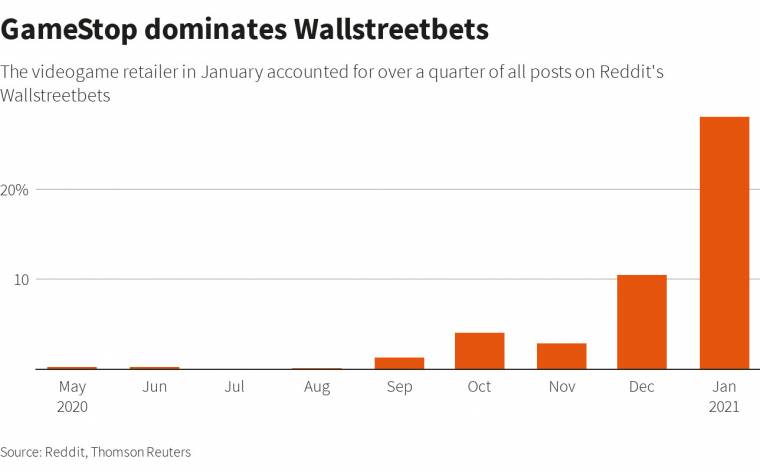

The flight is mainly due to Reddit users who launched a coordinated “attack” on investment fund managers who speculated for a further fall in GameStop shares. The clash has spread to the papers of other companies, including BlackBerry and AMC.

The fact that these small investors have been able to be so effective is not only the cause of anger and boredom, but also of free trading platforms such as Robinhood, founded a few years ago.

Experts say the investment fever was not only caused by amateur investors, stock prices largely reflect the fact that Ryan Cohen, who has already bought a large stake in GameStop a few weeks ago, several companies succeeded, and Elon Musk blew up Twitter again with his post in this regard.

In any case, the history of GameStop brings to mind many experts, it is not yet known whether this is the end result of the fundamental problems inherent in the market, it may be an anomaly, or maybe not everything is going on legally in the deal after one of Wall Street’s major Wall Street hedgefund managers, Melvin Capital, got out of a GameStop short sale after a multi-billion dollar loss.

United States Securities and Exchange Commission Its Securities and Exchange Commission (SEC) as well as the White House are also monitoring developments, but tech companies have also intervened, which raises serious questions. Several major online broker / broker apps (e.g. Robinhood is very popular among young people) have once started to restrict trading in stocks that revolutionaries have come up with to slash prices by buying, but this morning Facebook has already blocked a very popular a stock trading group (allegedly because of content that violates user policies, but many say they intervened because of the story above.)

So this means that now you can’t buy in more places, just sell. This is an attempt to prevent the price from being pushed further, which is clearly protecting fund management funds. The question, however, is: if there has been no violation of the law, on what basis can a broker, which in theory be a neutral intermediary, do so? Reddit users are already planning to take class action in the last half day, and the idea of a free market is facing one of the biggest tests of its life.

We will hear a lot more about this case.

The post Players and online forumers have done amazing chaos on Wall Street appeared first on World Weekly News.